child tax credit for december 2021 amount

That comes out to 300 per month through the. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021.

. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Child Care Tax Credit Calculator.

To be a qualifying child for the 2021 tax year your dependent generally must. The IRS will send you monthly payments for half your new credit between July and December 2021. How does the first phaseout reduce the 2021 Child Tax Credit to 2000 per child.

If the changes are not renewed the overall credit size will shrink by as much as 1000 per school-aged child and 1600 per child under 6 and the lowest-income families. What Will be the. The tool below is to only be used to help you determine what your 2021.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. The two most significant changes impact the credit amount and how parents receive the credit. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to.

Be under age 18 at the end of the year Be your son daughter stepchild eligible foster. The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules. As those two programs ended earlier this year the Child Tax Credit went into full swing in July directing as much as 300 per month to families for each eligible child.

Enter the number of qualifying dependents aged 5 or younger age as of december 31 2021 for tax year 2021 including dependents or. First the credit amount was temporarily increased from 2000 per child to. How Next Years Credit Could Be Different.

The IRS will pay 3600 per child to parents of young children up to age five. Added January 31 2022 Q A9. For children under 6 the amount jumped to 3600.

The percentage depends on your income. Lowers the phase out rate. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit for 2021 to get more help to more families. Child Tax Credit 2022.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis. Half of the money will come as six monthly payments and half as a 2021 tax credit.

Visit ChildTaxCreditgov for details. The CTC amount will start to gradually decrease. That changes to 3000 total for each child.

Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of theChild Tax Credit that you may properly claim on your 2021 tax. It has gone from 2000 per child. Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self.

For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. How does the second phaseout reduce the Child Tax.

The Child Tax Credit Toolkit The White House

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Tax Credit Definition How To Claim It

Childctc The Child Tax Credit The White House

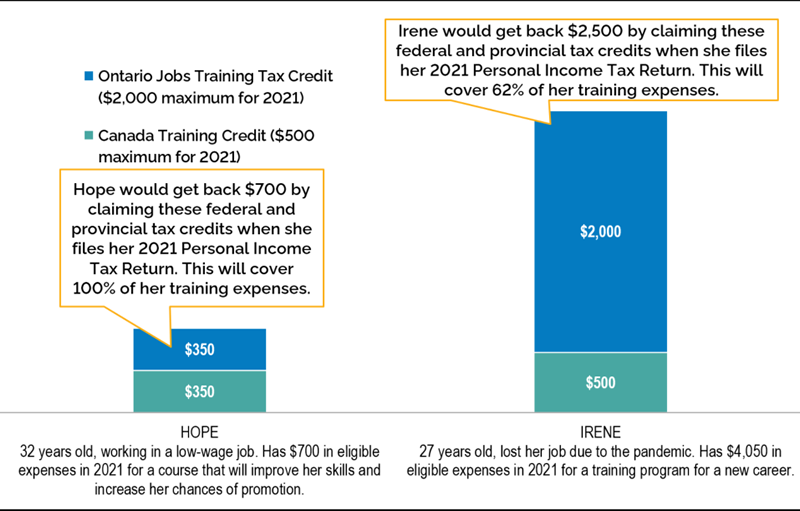

Ontario Jobs Training Tax Credit Ontario Ca

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit Definition Taxedu Tax Foundation

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

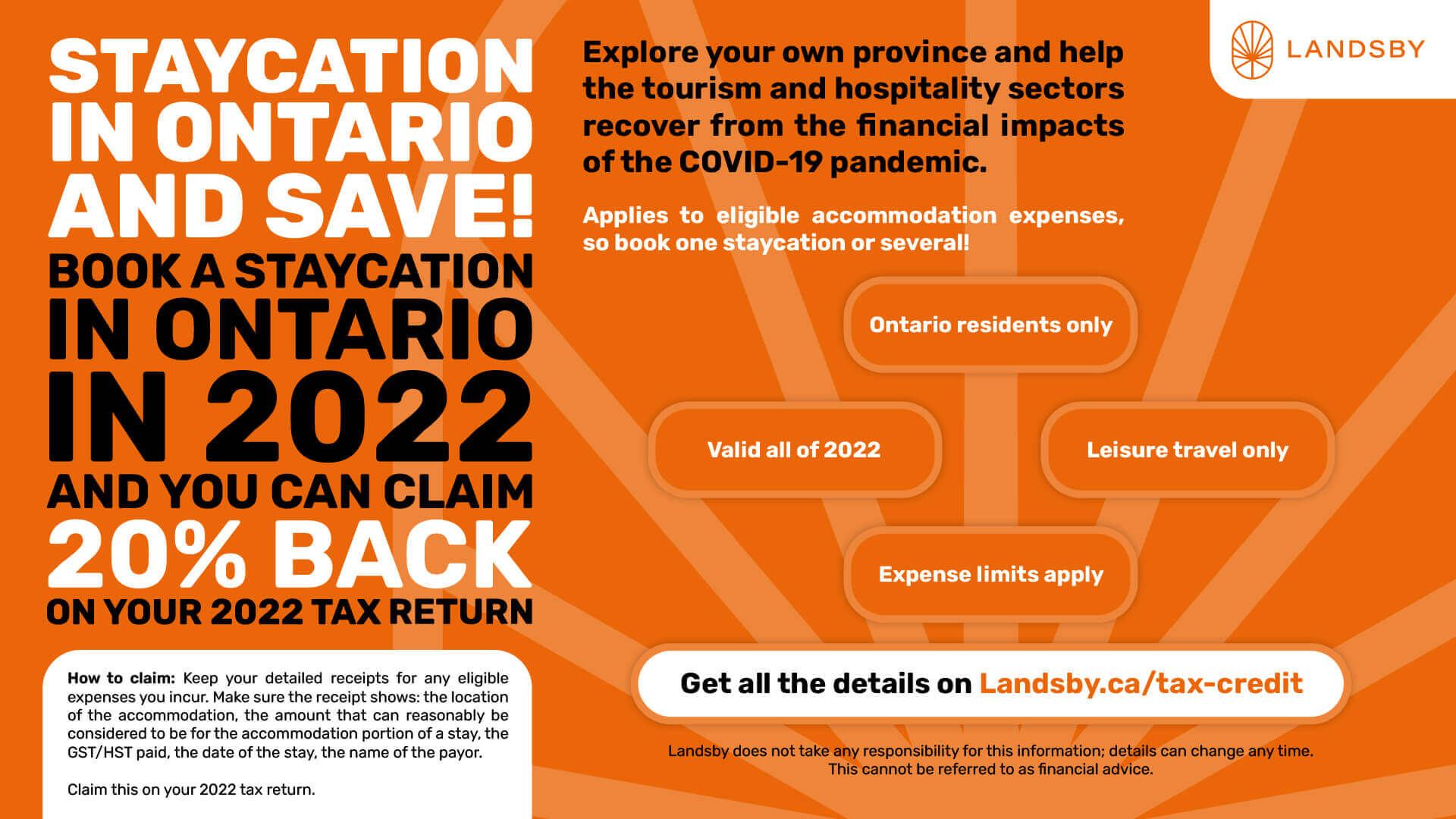

2022 Ontario Staycation Tax Credit Guide Landsby

Always Keep Employee Td1 S Up To Date Tax Credits Hiring Employees New Bus

Child Tax Credit Definition Taxedu Tax Foundation

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty